How to Properly Buy or Lease a New Car: Expanding your Turo Fleet

Finding the right car at the right price:

Have you ever been taken advantage of at a car dealership? Know friends and family that warn you to never trust a salesperson? Read this guide and you will never be that sucker that got put together by a unscrupulous car salesperson. My name is Jerry and as an Auto broker in LA I will show you some of my techniques in this article to help ensure you’re getting a fair deal for when deciding to purchase a car for your fleet. After you have decided on a specific car and performed basic financial calculations to determine profitability, you can follow these steps to make an educated car purchase/lease decision and add a profitable car for your Turo fleet. It will take practice and experience to develop your negotiation and research skills to get the best prices but use this guide as a foundation and you will never be the “lay down” at a dealership.

Confirming options and trim level

Find out the exact options and trim you want on the car. You can do this by visiting the manufacturer website. For Turo use I highly recommend getting a trim that has a few options that your guests will value. Do not make your decision solely on price. Imagine yourself as the guest: Would you rather pay $5 more for the car with the latest technology and sick wheels? One consideration that many hosts don’t factor into their decision is reselling the cars. Base model resale values typically are significantly lower than higher trims and also have a smaller buyer pool than decently equipped trims. That being said, once you have the car picked out, go to Truecar.com and input your information. This step is crucial because if you base your desired price on the incorrect trim, you will be looking for a nonexistent deal.

Finding the right price of your new car

Finding the right price of your new car

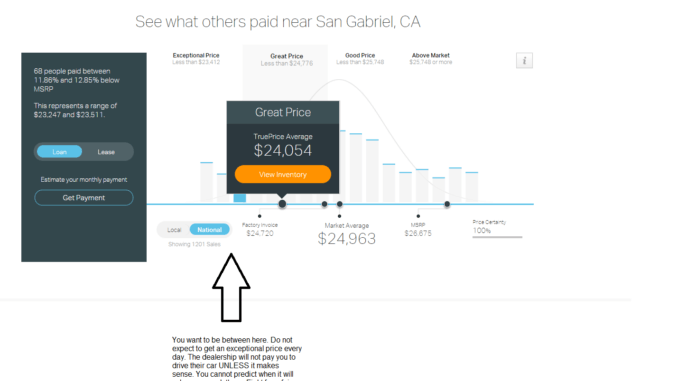

For today’s example we will be picking a 2018 Accord Sport (this was my first car that I added to my fleet and has been immensely popular). After you have correctly inputted the information you will see the page with a “Retail Price”. Make sure you the correct style is selected otherwise the price will not be accurate. We will be focusing on an Automatic 1.5L Turbo Sport. I selected with Cloth which yields a Retail Price of: $26,675. For my zip code “91776” you will see the information below.

Beware of Back end products!

A note: be sure to confirm this is the selling price of the vehicle. Many dealerships will include “add-ons” that are optional on the selling price of the car. Do not pay for paint protection, alarm, or any added dealer profit items that the salesperson will try to sell you. They are already on the car, you would merely be paying a premium for a warranty on those items. They will try to guilt you into buying them because they are already on the car but just tell them you only will consider the car if they negotiate from the price of $26,675. On to the pricing tool – scroll down and look for the “Price Curve”. This is a fairly accurate tool when it comes to finding out what other customers have paid for the same car recently. If you’re a beginner when it comes to negotiating at dealerships, try to aim for a “great price” when it comes to the selling price of the vehicle.

As you get more experienced, you can switch over and try to grind multiple dealerships to obtain the “exceptional prices”. Remember, the spread between an exceptional price and a great price is often only a few hundred dollars. Don’t delay the expansion of your fleet over that amount- you will incur more lost revenue than you would save by waiting for a deal that only happens in a blue moon. Note: there are no such things as “holiday sales”. If anything, you will be paying more because most people believe they will get a deal during this time and the dealerships will know that. They won’t give away a high demand vehicle with such a spike in demand. Dealership salespeople will try to push you to a deal. Don’t let them. Fight for the selling price and do not worry about the monthly payment or putting money down. Those are industry tricks to make you pay more for the vehicle. Focus on the selling price and you will get the best deal.

Incentive, Rebate, and Bank Rate Research!

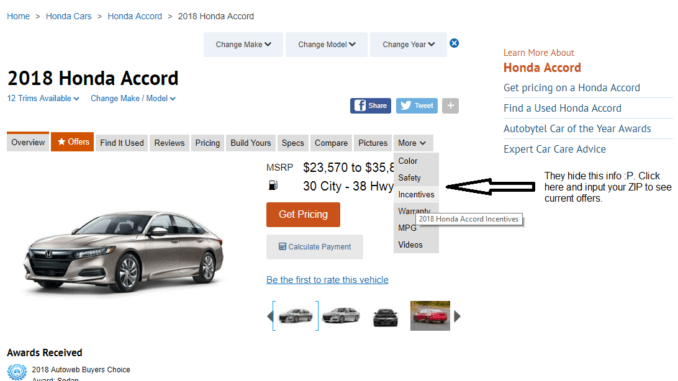

Now that you have a baseline price that you want to negotiate to you will need to identify any rebates, finance rates, and incentives that you qualify for. A huge part of the money a dealership makes comes from back end products. Given this, you need to be educated before sitting down with a finance manager who is trained to squeeze every last drop out of you. This one statement will make a huge impact in how good of a deal you get: everything is negotiable. Finance rate, warranties, money factor, acquisition fees, GAP insurance, and more are all high profit centers for dealerships. If you’re able to reduce your cost if you decide you need these products, you will save a ton of money the day you purchase a car. The rebates site I use is Autobytel.com. Let’s go and take a look for current incentives for the 2018 Accord Sport.

Select the correct trim and then you will see the correct Financing rebates and applicable rebates. If there is a “Lease Cash” or “Dealer Cash” do not allow the dealership to claim they are discounting the car when in fact they are using manufacture incentives to give the appearance of a discount. Always tell them to focus on the selling price first and then talk about what rebates you qualify for. For this example, these finance rates are what you would be approved for if you qualified for Tier 1 credit. If they mark it up at all, first inquire to see what your credit score is and confirm if you qualified for Tier 1. If you did, your interest rates should match these accordingly. If not, make sure they did not mark up the rate and be prepared to walk if they don’t sell you the car at the rate that the bank approved you for.

Do I or any one in my household qualify?

If you qualify for Military or College rebates, you will need to provide proof. I only have experience using the College rebate. You need to either be currently in school with a job offer within 6 months? (correct me if I am wrong) or have graduated within the last 2 years. You can qualify for college for both undergraduate or postgraduate studies. You’re not done here though. Be sure to check Edmunds forums for the money factor and residual of the car you’re looking for. Make sure the information you get is from this month because these rates will change from month to month. Dealerships WILL mark up your money factor but cannot mark up the residual. If you want an idea of the interest rate you are paying, just simply multiple the money factor by .0024 and you will have an approximate estimation of the APR of your lease.

Go to Google and search for “2018 honda accord sport money factor Edmunds”. This will bring up a list of results. Usually you’re looking for the first result. Make sure it’s on the Edmunds forums and should look like this:

Go to the last page and look for the relevant information. For us, we can focus on a 36 month 12k miles per year lease. In July you would have received a base .00092 Money factor rate and a 56% residual value for 36 months 12k miles per year assuming you qualify for Tier 1 credit. When you look at a dealer breakdown make sure the .00092 that you received on Edmunds matches the one that the dealership put in their cost breakdown. Fight to get the rate you qualified for (Some brands like Mercedes offer further money factor discounts if you put down Multiple Security Deposits or sign up for Autopay). If you can’t find the information for your exact car, just sign up for a forum account and post a request. Their moderators are very good at getting back to requests.

Step 4: Estimating your monthly payment

Now that you have the correct incentives and price that you wish to pay for your car, you are ready to estimate the target monthly payment and selling price of the vehicle. A little word of advice, go to Leasehackr and look for deals that occurred in the same month in your area. That will give you a good idea at what other car buyers have actually paid. You can also see if there are any rebates you missed that weren’t listed on Autobytel. Sometimes certain vehicles will also have Dealer cash that is not displayed on car research sites. Availability of incentives and rebates vary widely between dealers so you will need to gain some experience before you can comfortably know you have left no stone unturned.

Now is the fun part that you have all been waiting for. We can pretend to be a desk manager at a dealership! Go to Leasehackr and open up their calculator. When you open that page you will see a basic monthly payment calculator. Please note this is not always 100% accurate but will provide a good estimation of the price you pay. Also remember the Truecar price will sometimes be INCLUSIVE of rebates. Use everything that you have learned here as a general guideline. Don’t be stuck chasing a deal that doesn’t exist. If a dealership lets you walk that means there is almost no profit in the deal. Your job is to find the lowest price that they will accept that is within reason. If you walk into the Mercedes dealership and offer $30,000 for a $60,000 car they will rightfully tell you to get out.

LeaseHackr Calculator

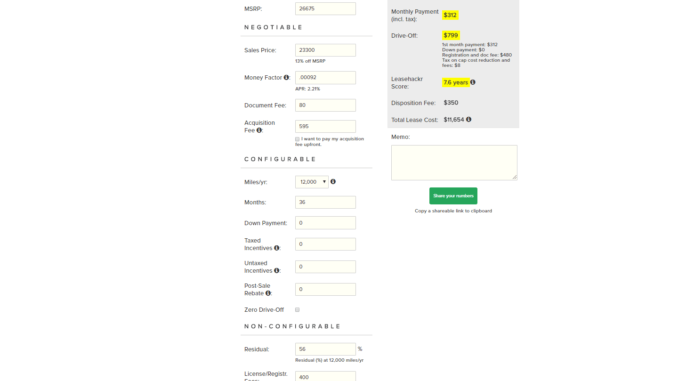

If you’re following along with the car that I have based this guide on your calculator should look like this.

Our monthly price post tax will be $312 with $799 drive-off. Do not get the drive-off confused with a down payment. If you’re looking to truly drive off with the car without putting a penny down, you would roll the drive-offs into the cost of the lease. A lot of dealerships will claim 0 down on their ads, but when you show up at the dealership they will tack on fees to the drive-offs so that you pay thousands in drive offs. A down payment in a car lease or purchase is simply a capital cost reduction. Imagine the car loan/lease as a big dollar amount. Your down payment will reduce the capital borrowed to lower the total amount of interest you pay. In car loans and leases your interest and money factor are usually significantly under the cost of inflation so you should NEVER put a down payment at signing (unless you have poor credit at which point you should focus on improving that before expanding your fleet). As a Turo fleet owner you want to make sure you have as much free cash flow as possible. You want to be able to cover periods of revenue loss in case one of your fleet becomes disabled due to an accident.

Wrap up: Let’s expand our Turo fleet!

In conclusion, by following this guide on buying and leasing new cars you are better prepared to expand your fleet. While just this information in the guide won’t make you an expert on the topic of buying or leasing new cars, it will help prevent you from getting a terrible deal. If you don’t want or don’t have the time to visit many dealerships or would just prefer not to negotiate, I do provide a fleet building service in Los Angeles where you can tell me the exact cars you want for your fleet and I can deliver the cars to your home. I am an auto broker that will get your similar deals to what I get for my own fleet at no cost to you. The broker fee will be structured into the deal and I always encourage my clients to attempt to get a better price on their own. If I am not in your area I also can do the preparation for you. For a flat fee you can tell me the specific cars you want and I will contact dealerships in your area to arrange a deal that you will love (check out all of the services I provide here). I hope you all found this guide to be helpful. Good luck in your Turo journey and remember to contact me if you have any questions :)!

Do you use CarGuru’s website to see if the car is a great deal?

Hi Ozzie,

No, I use TrueCar as an estimator of a good price and then do research on forums like Leasehackr to find the most aggressive price.

Hi Jerry,

What about the mileage? is 12k/year enough for listing it on Turo?

Hi Mike,

Depending on your mileage restrictions, personal use, and market 12K may not be enough. Note: if a leasing company charges .25/mile over and you can get $60 in revenue for every 100 miles, it’s a win to go over. Don’t be afraid to exceed your lease’s limitations. You can either return the car early provided you have made all of the payments, or buy out the car if the buy out price is advantageous (higher than auction/trade in).

From my experience, my cars have put on 15-20k/year in Los Angeles. My market attracts a ton of tourists so I would guess that this is on the high end in terms of mileage.

I live in San Francisco and decided to start Turo by either getting a Smart ForTwo or a Prius. I found used 201 Smart cars for around $6,500 and 2015 Toyota Prius for around $12,000. IS a good idea to buy one of these used outright? I just don’t want to deal with interest or lease payments with my first car on Turo.

Your thoughts would be greatly appropriated

Hello!

I wouldn’t worry about interest on car loans (there’s no prepayment penalty and is simple interest). It’s okay to leverage yourself as long as you acquire the cars at decent prices.

Other than the negative connotation attached to financing/leasing a car what other reasons cause you to shy away from doing so?

Hi! Thanks for your informative post. How does leasing under an LLC work? Are there any terms in the lease agreements that prohibit you from car-sharing?

Great article Jerry! One question though, when I search rebates on Autobytel for a Ford Mustang, several come up. (ex, 1500 – Bonus Cash(RCL Customer Cash), 1500 – Stand Alone Cash(Retail Customer Cash), 750 – Bonus Cash(Select Inventory)) Are these all able to used or just one?